Ranter

Join devRant

Do all the things like

++ or -- rants, post your own rants, comment on others' rants and build your customized dev avatar

Sign Up

Pipeless API

From the creators of devRant, Pipeless lets you power real-time personalized recommendations and activity feeds using a simple API

Learn More

Comments

-

donkulator709118dThere must be a vaguely adequate system that can tell them where the money is, otherwise the whole company would disappear up its own arse.

donkulator709118dThere must be a vaguely adequate system that can tell them where the money is, otherwise the whole company would disappear up its own arse.

They won't make that functionality available to end users because the more efficient things are the less scope there is for corruption. -

Lensflare22088118dMaybe they have troubles processing the countless transactions of millions of dollars from princes.

Lensflare22088118dMaybe they have troubles processing the countless transactions of millions of dollars from princes. -

D-4got10-012899117d@Lensflare Found both of your comments funny.

D-4got10-012899117d@Lensflare Found both of your comments funny.

But if you want to up your game, you need to invest in a FunnyBot. I hear it's killing it.

https://youtube.com/watch/... .

/jk -

Nmeri17269117d@molaram Quick google search showed this

"Requirements for Obtaining Licenses:

Minimum Capital Requirements:

Vary depending on the type of license. For example, commercial banks need substantial capital, ranging from ₦10 billion to ₦50 billion, according to Mondaq."

https://mondaq.com/nigeria/...

It's extremely expensive so most plucky guys wishing to eke a living from the fintech sector perch around projects with superficial capabilities, leveraging apis provided by highly funded startups or banks where possible

Related Rants

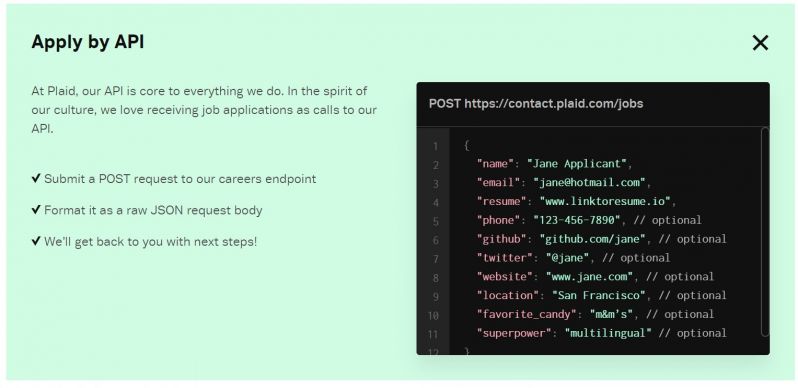

This is just wrong..

This is just wrong.. Just a Developer thing!. You can apply for jobs through APIs.

Just a Developer thing!. You can apply for jobs through APIs.

I don't know about your country but this feature is novel among Nigeria's financial institutions. What usually happens in a typical bank app is same as above: fields are provided for entering account details. There is no way to know the outcome of the transfer until it's made. If it fails in transit (often, you're debited but the recipient gets nothing), you might get a reversal if you're lucky, after an indefinite period of time. Otherwise, you have to take it up with your bank or the recipient's bank. Or worse, with the central bank, when the first two are not being helpful enough

Enter this new generation fintech (Opay). They offer an addition that impresses all customers: after selecting the bank, a popup appears that notifies you on the stability of the receiver's network. Someone sent me this screenshot seeking my permission or provision of another bank. I didn't think much of it and asked them to proceed. To my surprise, transaction failed and their money instantly reversed

Those traditional banks clearly have no api for health checks, otherwise they'd all adopt it within their own apps. So, how is this possible? My only guess is that Opay maintains their own health checks system that is updated maybe by periodically pinging those banks with nominal fees like N1 and verifying whether money was received

It's obviously primitive but I doubt traditional bank apis return a failure response (since none currently tells you when transaction failed). So you'd have to rely on workarounds emulating manual and automated testing

To those in the fintech sector or with a faint idea of what's going on, can you explain?

question

fintech

transaction