Join devRant

Do all the things like

++ or -- rants, post your own rants, comment on others' rants and build your customized dev avatar

Sign Up

Pipeless API

From the creators of devRant, Pipeless lets you power real-time personalized recommendations and activity feeds using a simple API

Learn More

Search - "income tax"

-

- Hello! Gordon's pizza?

- No sir it's Google's pizza.

- So it's a wrong number?

- No sir, Google bought it.

- OK. Take my order please ..

- Well sir, you want the usual?

- The usual? You know me?

- According to our caller ID, in the last 12 times, you ordered pizza with cheeses, sausage, thick crust

- OK! This is it

- May I suggest to you this time ricotta, arugula with dry tomato?

- No, I hate vegetables

- But your cholesterol is not good

- How do you know?

- Through the subscribers guide. We have the result of your blood tests for the last 7 years

- Okay, but I do not want this pizza, I already take medicine

- You have not taken the medicine regularly, 4 months ago, you only purchased a box with 30 tablets at Drugsale Network

- I bought more from another drugstore

- It's not showing on your credit card

- I paid in cash

- But you did not withdraw that much cash according to your bank statement

- I have other source of cash

- This is not showing as per you last Tax form unless you got it from undeclared income source

-WHAT THE HELL? Enough! I'm sick of Google, Facebook, twitter, WhatsApp. I'm going to an Island without internet,where there is no cell phone line and no one to spy on me

- I understand sir, but you need to renew your passport as it has expired 5 weeks ago..42 -

Hello! Is this Gordon’s Pizza?

No sir, it’s Google’s Pizza.

Did I dial the wrong number?

No sir, Google bought the pizza store.

Oh, alright - then I’d like to place an order please.

Okay sir, do you want the usual?

The usual? You know what my usual is?

According to the caller ID, the last 15 times you’ve ordered a 12-slice with double-cheese, sausage, and thick crust.

Okay - that’s what I want this time too.

May I suggest that this time you order an 8-slice with ricotta, arugula, and tomato instead?

No, I hate vegetables.

But your cholesterol is not good.

How do you know?

Through the subscribers guide. We have the results of your blood tests for the last 7 years.

Maybe so, but I don’t want the pizza you suggest – I already take medicine for high cholesterol.

But you haven’t taken the medicine regularly. 4 months ago you purchased from Drugsale Network a box of only 30 tablets.

I bought more from another drugstore.

It’s not showing on your credit card sir.

I paid in cash.

But according to your bank statement you did not withdraw that much cash.

I have another source of cash.

This is not showing on your last tax form, unless you got it from an undeclared income source.

WHAT THE HELL? ENOUGH! I’m sick of Google, Facebook, Twitter, and WhatsApp. I’m going to an island without internet, where there’s no cellphone line, and no one to spy on me …

I understand sir, but you’ll need to renew your passport … it expired 5 weeks ago.16 -

!(short rant)

Look I understand online privacy is a concern and we should really be very much aware about what data we are giving to whom. But when does it turn from being aware to just being paranoid and a maniac about it.? I mean okay, I know facebook has access to your data including your whatsapp chat (presumably), google listens to your conversations and snoops on your mail and shit, amazon advertises that you must have their spy system (read alexa) install in your homes and numerous other cases. But in the end it really boils down to "everyone wants your data but who do you trust your data with?"

For me, facebook and the so-called social media sites are a strict no-no but I use whatsapp as my primary chating application. I like to use google for my searches because yaa it gives me more accurate search results as compared to ddg because it has my search history. I use gmail as my primary as well as work email because it is convinient and an adv here and there doesnt bother me. Their spam filters, the easy accessibility options, the storage they offer everything is much more convinient for me. I use linux for my work related stuff (obviously) but I play my games on windows. Alexa and such type of products are again a big no-no for me but I regularly shop from amazon and unless I am searching for some weird ass shit (which if you want to, do it in some incognito mode) I am fine with coming across some advs about things I searched for. Sometimes it reminds me of things I need to buy which I might have put off and later on forgot. I have an amazon prime account because prime video has some good shows in there. My primary web browser is chrome because I simply love its developer tools and I now have gotten used to it. So unless chrome is very much hogging on my ram, in which case I switch over to firefox for some of my tabs, I am okay with using chrome. I have a motorola phone with stock android which means all google apps pre-installed. I use hangouts, google keep, google map(cannot live without it now), heck even google photos, but I also deny certain accesses to apps which I find fishy like if you are a game, you should not have access to my gps. I live in India where we have aadhar cards(like the social securtiy number in the USA) where the government has our fingerprints and all our data because every damn thing now needs to be linked with your aadhar otherwise your service will be terminated. Like your mobile number, your investment policies, your income tax, heck even your marraige certificates need to be linked with your aadhar card. Here, I dont have any option but to give in because somehow "its in the interest of the nation". Not surprisingly, this thing recently came to light where you can get your hands on anyone's aadhar details including their fingerprints for just ₹50($1). Fuck that shit.

tl;dr

There are and should be always exceptions when it comes to privacy because when you give the other person your data, it sometimes makes your life much easier. On the other hand, people/services asking for your data with the sole purpose of infilterating into your private life and not providing any usefulness should just be boycotted. It all boils down to till what extent you wish to share your data(ranging from literally installing a spying device in your house to them knowing that I want to understand how spring security works) and how much do you trust the service with your data. Example being, I just shared most of my private data in this rant with a group of unknown people and I am okay with it, because I know I can trust dev rant with my posts(unlike facebook).29 -

- Hello! Gordon's pizza?

- No sir it's Google's pizza.

- So it's a wrong number?

- No sir, Google bought it.

- OK. Take my order please ..

- Well sir, you want the usual?

- The usual? You know me?

- According to our caller ID, in the last 12 times, you ordered pizza with cheeses, sausage, thick crust

- OK! This is it

- May I suggest to you this time ricotta, arugula with dry tomato?

- No, I hate vegetables

- But your cholesterol is not good

- How do you know?

- Through the subscribers guide. We have the result of your blood tests for the last 7 years

- Okay, but I do not want this pizza, I already take medicine

- You have not taken the medicine regularly, 4 months ago, you only purchased a box with 30 tablets at Drugsale Network

- I bought more from another drugstore

- It's not showing on your credit card

- I paid in cash

- But you did not withdraw that much cash according to your bank statement

- I have other source of cash

- This is not showing as per you last Tax form unless you got it from undeclared income source

-WHAT THE HELL? Enough! I'm sick of Google, Facebook, twitter, WhatsApp. I'm going to an Island without internet,where there is no cell phone line and no one to spy on me

- I understand sir, but you need to renew your passport as it has expired 5 weeks ago..11 -

This happened a while back but thought it would be an interesting story.

So there is this guy, I'll call him Jack. Jack was a weirdo. He just graduated high school but thought of himself as very hot in terms of dev skills. He boasted lots of good programs, that are the best in industry, except they don't work (like the best proven file compressor, that just can't decompress anything because of some "bugs"). He also entered language holy wars quite actively, saying that Delphi is the best platform ever.

Aaanyway, a couple of years pass. Jack is now a student. Jack tries to make some money, so he talks to some guy, that offers him a "job" at the tax office, where he has to modernize the data infrastructure of the tax authorities. If you think this sounds very wrong, then you're 100% correct. But it gets better. After 2 months of work, the guy manages to do that. It's a simple CRUD application after all.

So everything works, but the guy who gave him this job refused to pay. He stalled and then just stopped answering the phone. Jack is now furious. So what he does, is publish the databases online, so everyone could see the income of every citizen. Authorities are in panic. They send the police to his door. They seize his computer and lock him up for a few days.

To sum it all up: Jack took up a job, without any contract, without any NDA, which is completely illegal in of itself, but he did that with the tax authority. And delivered the product before getting paid. And when he understood that he was owned, he published all online. He got bit back. The guy who gave him this job had no consequences for illegally hiring someone and not paying for their work.

Lesson: Don't be Jack11 -

Oh I forgot.

Once I got promoted with more responsibility and my pay raised, but since I just passed some tax threshold for few $ my net income was more or less 1 hundred $ lower than before the promotion...7 -

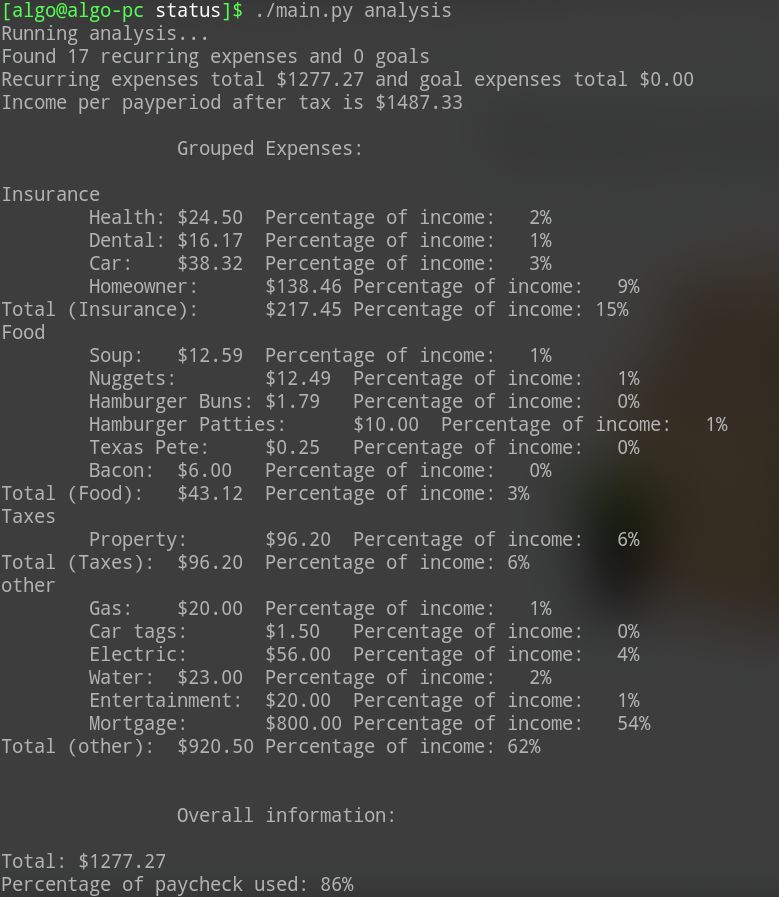

Here is the first step of my software that will keep track of "what bills am I currently paying?" throughout your day. This is analysis mode, you can specify your expenses and income (after tax) in a json file and it will build this report for you.

Here's an example with relatively realistic figures

The next step is to visualize it and have it render some charts and graphs. Yay! 9

9 -

Alright. This is going to be long and incoherent, so buckle up. This is how I lost my motivation to program or to do anything really.

Japan is apparently experiencing a shortage of skilled IT workers. They are conducting standardized IT skill tests in 7 Asian countries including mine. Very few people apply and fewer actually pass the exam. There are exams of different levels that gives you better roles in the IT industry as you pass them. For example, the level 2 or IT Fundamental Engineering Exam makes you an IT worker, level 3 = capable of working on your own...so on.

I passed level 1 and came in 3rd in my country (there were only 78 examinees lol). Level 2 had 2 parts. The theoretical mcq type exam in the morning and the programming mcq in the afternoon. They questions describe a scenario/problem, gives you code that solves it with some parts blanked out.

I passed the morning exam and not the afternoon. As a programmer I thought I'd be good at the afternoon exam as it involves actual code. Anyway, they give you 2 more chances to pass the afternoon exam, failing that, you'll have to take both of them the next time. Someone who has passed 1 part is called a half-passer and I was one.

A local company funded by both JICA and my government does the selection and training for the Japanese companies. To get in you have to pass a written exam(write code/pseudocode on paper) and pass the final interview in which there are 2 parts - technical interview and general interview.

I went as far as the interview. Didn't do too good in the technical interview. They asked me how would I find the lightest ball from 8 identical balls using a balance only twice. You guys probably already know the solution. I don't have much theoritical knowledge. I know how to write code and solve problems but don't know formal name of the problem or the algorithm.

On to the next interview. I see 2 Japanese interviewers and immediately blurt out konichiwa! The find it funny. Asked me about my education. Say they are very impressed that self taught and working. The local HR guy is not impressed. Asks me why I left university and why never tried again. Goes on about how the dean is his friend and universites are cheap. foryou.jpg

The real part. So they tell me that Japanese companies pay 250000/month, I will have to pay 60% income tax, pay for my own accommodation, food, transportation cost etc. Hella sweet deal. Living in Japan! But I couldn't get in because the visa is only given to engineers. Btw I'm not looking to invade Japan spread my shitskin seed and white genocide the japs. Just wanted to live in another country for a while and learn stuff from them.

I'll admit I am a little salty and probably will remain salty forever. But this made me lose all interest in programming. It's like I don't belong. A dropout like me should be doing something lowly. Maybe I should sell drugs or be a pimp or something.

But sometimes I get this short lived urge to make something brilliant and show them that people like me are capable of doing good things. Fuck, do I have daddy issues?16 -

I'm so fucking frustrated with my ex company CEO, this motherfucker made everyone move to Bangalore costing is employees a good chunk of their salary and this delusional ASSHOLE knew that only half of the expected funding was coming in January 2023 itself and they'd be out of funds by July/August, they let go few folks from the team, fired the entire marketing team and expected to make the product profitable. The only reason I had stayed at that time was because the product was interesting to build and the scale I was working with was crazy like 100k request per minute peaks and avg of 10k rpm. I left the company in August...

This MOTHERFUCKER hasn't paid out final settlement after leaving for most employees and he openly says to the folks who are still working there that paying us is not his priority.

I hope your Atlas cluster gets fucking deleted, accesses revoked and entire AWS setup goes down forever, bitch.

We can't goto courts because the company law tribunal needs atleast 1 crore (1.2 million usd) of unpaid dues to declare it insolvent in a years time..

This asshole deducted taxes from our salaried but didn't pay them to the income tax department for an entire fucking financial year.

What a cheating, delusional, sick bastard. And he's still not willing to sell off the company to pay off the debts and call it a day.

Aarrghhhh on top of losing 2-3k USD I might have to pay my taxes approx 5-6k USD to the govt to keep my records well maintained.

What a grade A delusional asshole 😡

If he won't clear the dues till December, I'm gonna launch a mass of social media posts and destroy his reputation so that he doesn't get one penny of VC funds in the future I'm gonna make sure of that...4 -

TLDR;

How much do you earn for your skill set in your country vs your cost of living?

BONUS;

See how much I & others earn.

Recently I became aware of just how massive the gap in developers earnings are between countries. I'd love to calculate a fixed score for income vs cost of living.

I know this stuff is sensitive to some so if you prefer just post your score (avg income p/m after tax / cost of living).

I'm not shy so I'll go first:

MY RATES

Normal Rate (Long term): $23

Consulting / Short term: $30-$74

Pen Test: $1500 once off.

Pen Test Fixes: consulting rate.

Simple work/websites: min $400+

Family & Friends: Dev friends are usually free (when mutually beneficial). Family and others can fuck off, even if they can pay (I pass their info to dev friends with fair warning).

GENERAL INFO

Experience: 9 years

Country: South Africa

Developer rareness in country: Very Rare (+-90 job openings per job seeker).

Middle class wage in country: $1550 p/m (can afford a new car, decent apartment & some luxuries like beer/eating out).

Employment type: Permanent though I can and do freelance occasionally.

Client Locality: Mostly local.

Developer Type: Web Developer (True web dev - I do anything web related from custom HTTP servers to sockets, services, advanced browser api's, apps & more).

STACKS / SKILLSETS

I'M PROFICIENT IN:

python, JavaScript, ASP classic, bash, php, html, css, sql, msql, elastic search, REST, SOAP, DOM, IIS, apache

I DABBLE WITH:

ASP.net, C++, ruby, GO, nginx, tesseract

MY SPECIALTIES:

application architecture, automation, integrations, db's, real time data, advanced browser apps/extensions (webRTC, canvas etc).

SUMMARY

Avg income p/m after tax: $2250

Cost of living (car+rent+food): $1200

Score: 1.85

*Note: For integrity when calculating my cost of living I excluded debt repayments and only kept my necessities which are transport, food & shelter.

I really hope you guy's post your results, it would be great to get an idea of which is really the worst / best country to be a developer in.20 -

The company that manages my ISA for Lambda emails on a regular basis to get you to update your income. I got annoyed by the frequency while I was employed so started filtering everything.

Though I’ve been up to date with reporting income to them and submitting tax documents, etc, I apparently missed some important emails.

Like the one on the 4th saying a third party provider flagged by account for employment with CompanyA and that I needed to submit my pay stubs for CompanyA.

I do not and have never worked for CompanyA. My husband works for CompanyA.

I also missed the email from the 12th saying I’m in breach of contract and owe them $19,091.65 immediately.

*head desk*

I’m so mad I can’t even.

Why did i check my email before going to sleep?

AND I POSTED RECENTLY SO I CAN’T EVEN RANT YET. *

*Waited it out -

From such a healthy environment this job turned into an extremely toxic one. Now i finally understand how a toxic environment looks like. It's extremely disgusting. Putting 5 tasks on my name to work in parallel and as i work they put 2 more. All High priority tasks. It is physically impossible. The scrum master whore told me to just check the code how to do something to users and understand this for monday so i can help QA guy to test it. I went over the code with a colleague and understood it. Today she screamed at me angry i didnt do the task. What the fuck are you talking about? I checked the code and im ready to do help the QA guy test it whenever necessary. Then she talked shit changing the task that i was supposed to not only understand the code but also do the task on Monday and now its the end of tuesday and its not done. Fuck you. That was not what she said initially. Its very Fucking confusing. Then she said to QA guy i give up i cant handle it with this guy sorry but ill have to report this to product owner. So be it. I dont give a fuck. I am ALONE working on a GIANT, unmaintainable, spaghetti, caveman technology codebase with broken outdated or nonexistent docs, nobody to help me, the colleague whos supposed to guide me is a good guy but overloaded with tasks himself so he doesnt have time, i him and many of us requested another person to join to work with me on same role but they dont have the budget which is a Fucking lie, a client worth trillions of dollars does not have a budget, yeah get fucked retards. This suffering and downfall of your project is mostly their fault. Theyre too arrogant and proud to understand or admit that it's not possible physically for 1 person to manage and keep knowledge and code on 7 tasks per day. All that for Fucking $8 an hour?????????? I hope cancer eats all of u. Every single one to the very fucking bones till ur bones break. This is fucking disgusting and sickening. Right when i was supposed to get paid $17 an hour (and thats gross income not even net.....) I am now fucking forced to quit this shithole toxic job. Because i realized no amount of fucking money, not even before-tax-$17-an-hour money is worth the weight of stress that i get punched with every fucking day. No fucking job is worth more than health. This is saddening and depressing extremely. All of my fucking plans are ruined. The car to buy on leasing--ruined by a whore. The 2 day vacation this week--ruined by a whore. Going out with my hot blonde gf during this miserable 2 day vacation--ruined by a whore. Meeting with 2 american clients I've been in touch with for several years to work on a side project--ruined by a whore, meeting canceled and delayed due to my overtime work. I am literally fucking treated like the Moscow Crocus Hall terrorist. They have no fucking sympathy or understanding for how fucking HARD this fucking DevOps job is where i work on a 30 year old legacy codebase with no fucking help. It is simply not possible. Now its a race between who's gonna fuck who: either i quit first or they fire me first. At this point its not a matter of if but when. Surely soon enough. Cant wait to get the FUCK away from these pieces of shitheads. I either have option to cry and go mentally insane by giving it my all until i fix the task on time but the stress i would get for that would need them to pay me at least 9 mill $ a year. Fuck with someone else you fucking retards. You're using slave labor to work for basically free just so u can profit a lot. Literally on the meeting one of their bosses said they get 50% of margin which is a lot in biz world for tech field. This is absolutely sickening and saddening that im treated like a fucking terrorist. Fucking Disgusting. Cant wait to not Ever fucking work in this toxic fucking place. Quitting by max 1st of april.2

-

Who knew taxes were supposed to be temporary, until they became mundane and permanent part of lives.

https://history.com/news/...7 -

Overall, pretty good actually compared to the alternatives, which is why there's so much competition for dev jobs.

On the nastier end of things you have the outsourcing pools, companies which regularly try to outbid each other to get a contract from an external (usually foreign) company at the lowest price possible. These folks are underpaid and overworked with absolutely terrible work culture, but there are many, many worse things they could be doing in terms of effort vs monetary return (personal experience: equally experienced animator has more work and is paid less). And forget everything about focus on quality and personal development, these companies are here to make quick money by just somehow doing what the client wants, I'm guessing quite a few of you have experienced that :p

Startups are a mixed bag, like they are pretty much everywhere in the world. You have the income tax fronts which have zero work, the slave driver bossman ones, the dumpster fires; but also really good ones with secure funding, nice management, and cool work culture (and cool work, some of my friends work at robotics startups and they do some pretty heavy shit).

Government agencies are also a mixed bag, they're secure with low-ish pay but usually don't have much or very exciting work, and the stuff they turn out is usually sub-par because of bad management and no drive from higher-ups.

Big corporates are pretty cool, they pay very well, have meaningful(?) work, and good work culture, and they're better managed in general than the other categories. A lot of people aim for these because of the pay, stability, networking, and resume building. Some people also use them as stepping stones to apply for courses abroad.

Research work is pretty disappointing overall, the projects here usually lack some combination of funding, facilities, and ambition; but occasionally you come across people doing really cool stuff so eh.

There's a fair amount of competition for all of these categories, so students spend an inordinate amount of time on stuff like competitive programming which a lot of companies use for hiring because of the volume of candidates.

All this is from my experience and my friends', YMMV.1 -

Ran a DecSecOps consultant business for many years. Used it as supplemental income because it never made enough to be a main gig. It was a great tax write off2

-

First year on the job. Was already good at writing software, but bad at practices and administration. One such software was being tested live, while still in development. I was developing on the production database... .

Yeah.

I was working on an edit feature of sales records, in a table that already contained hundreds of subsidized sales of very expensive products. Based on that, the supplier had to compensate the shops with half the price of every item.

I forgot to add a where clause to the update. Lost all sales data. On production.

Asked the admin if there are backups and he says yes, checks to discover that the backup script failed for the last week (since it became live)

Whole thing was incredibly stupid. I made a ton of stupid mistakes, and so did the other people involved. The loss was around 1 year of my income. Luckily the client decided to brush it off as losses and claim some tax benefits and it all ended well.1 -

!dev

did my taxes months ago with the official software. because i was honest enough to mention a 250€ (annually) income for a freelance job i was later forced to submit a form for entrepeneurs. well, ok. let's use the official software for that. "yes we have the form, but no, you are not allowed to use it from this year on, please use our online service"

two weeks later (!) i receive the token to complete registration. while trying to fill the form i recognize german tax system is exactly the recursive piece of incomprehensible shit like the attached help text. 4

4 -

Any devs here from Canada or who have worked there?... know any?

I'm strongly considering immigrating to Canada to give my future family a better chance at life (My current country has a highly unstable political climate).

Just wondering how the dev lifestyle is living there (for the average dev) i.e.

- Quality of life - I know I can't buy a house, but what can I rent? A house/ flat/ box?

- Hows the dev scene / culture?

- Work life balance / Work environment frustrations (I hear they are very politically correct and this may be a conflict with my blunt nature)

- Income Tax vs Government service delivery, I expect tax will be high due to free health care/ education but are they worth it? nb; any service delivery beats what I get...

Any feedback is welcome and will be appreciated.10 -

I'm looking into buying a new laptop. I want something speak and ultrabookish, but dedicated graphics are a must.

Will be mostly for work, so a good CPU and RAM are important, but probably will do some gaming. Battery life and cooling are pretty big too. I've looked at the Aero 15X, the XPS 15, Razer Blade, etc. I just can't decide. Need to get it this year for the the tax deductions for my contracting income. Any thoughts? What's the best one out there?12 -

I'm pleased to announce that, I too, have the 'unfortunate' to join the higher tax bracket payment where I will involuntary pay a portion of my income to the 'FICA people' for no returning benefits whatsoever.5

-

Lighthouse Bookkeeping LLC: Expert Bookkeeping Services for Service Businesses with Comprehensive Financial and Monthly Reports

Running a service business requires careful attention to detail, especially when it comes to managing your finances. At Lighthouse Bookkeeping LLC, we specialize in offering tailored bookkeeping for service businesses, ensuring that your financial records are organized, accurate, and up to date. Our expert team provides a wide range of services, from generating detailed bookkeeping financial reports to delivering bookkeeping monthly reports that help you make informed business decisions.

Located in Brentwood, TN, Lighthouse Bookkeeping LLC is dedicated to helping service-based businesses stay on top of their financial obligations and avoid costly mistakes. Whether you're a consultant, contractor, healthcare provider, or any other type of service business, we are here to manage your financials and provide the reports you need to track your success.

Why Bookkeeping is Essential for Service Businesses

Service businesses face unique challenges when it comes to financial management. Unlike product-based businesses, service-based companies may deal with fluctuating revenues, project-based billing, and different client payment schedules. Keeping track of income and expenses accurately is vital to ensure profitability, tax compliance, and financial growth.

Bookkeeping for service businesses is essential for the following reasons:

Accurate Financial Tracking

Service businesses often operate on contracts or agreements with varying payment schedules. Proper bookkeeping ensures that all client invoices, payments, and expenses are accurately recorded, giving you a true picture of your business’s financial health.

Expense Management

Service businesses may incur expenses related to travel, supplies, marketing, and more. By tracking these expenses properly, we help ensure that your books remain organized and you can easily identify opportunities to cut costs or increase profits.

Tax Compliance

Bookkeeping is essential to staying compliant with tax regulations. We ensure that your financial records are accurate and complete so that you can file your taxes without any issues. This helps you avoid penalties and take advantage of all potential tax deductions.

Cash Flow Management

For service businesses, cash flow can fluctuate depending on the nature of contracts and billing cycles. We help you keep track of incoming payments and outgoing expenses, ensuring that you have enough working capital to operate smoothly.

How We Provide Comprehensive Bookkeeping Financial Reports

At Lighthouse Bookkeeping LLC, we understand that financial reports are the backbone of decision-making. Our bookkeeping financial reports provide a detailed view of your business’s financial performance, allowing you to assess profitability, track your financial goals, and make strategic business decisions.

Our bookkeeping financial reports include:

Profit and Loss (P&L) Statements

The P&L statement shows your business’s income and expenses over a specific period. It helps you understand your revenue, cost of goods sold, and operating expenses, giving you insights into whether your business is profitable.

Balance Sheet

The balance sheet provides a snapshot of your business’s financial position at a given point in time, listing your assets, liabilities, and equity. It helps you assess your business’s financial stability and ability to cover its debts.

Cash Flow Statement

The cash flow statement tracks the flow of cash in and out of your business. This report provides essential information for managing cash flow, helping you ensure that you have sufficient cash to cover day-to-day expenses.

Accounts Receivable and Accounts Payable Reports

These reports track outstanding payments from clients (accounts receivable) and amounts you owe to vendors (accounts payable). They are essential for maintaining healthy cash flow and ensuring you are on top of any outstanding financial obligations.

Job or Project-Based Reports

For service businesses that work on projects or contracts, we provide detailed reports that break down income and expenses related to specific jobs, helping you assess the profitability of individual projects or clients.

The Importance of Bookkeeping Monthly Reports

In addition to providing periodic financial statements, bookkeeping monthly reports offer a snapshot of your business’s financial status on a month-to-month basis. These reports allow business owners to track performance, analyze trends, and make timely adjustments to their strategies.

Here’s why bookkeeping monthly reports are critical for service businesses:7 -

Nam Dinh Vu Industrial Park: An Attractive Option for Singaporean Investors

Nam Dinh Vu Industrial Park in Hai Phong, Vietnam, has become a key destination for foreign direct investment (FDI), attracting businesses from around the world, including Singapore. With its strategic advantages and favorable investment climate, Singaporean enterprises have achieved significant success, offering valuable insights into effective investment practices.

A major factor contributing to this success is Nam Dinh Vu’s strategic location within the Dinh Vu – Cat Hai Economic Zone. As the only industrial park in Hai Phong with an integrated international seaport—Nam Dinh Vu Port—it provides direct access to major maritime routes, reducing transportation costs and optimizing supply chain efficiency. The park features state-of-the-art infrastructure, including container terminals and liquid cargo ports, supporting diverse logistics needs. These advantages have made it an attractive destination for Singaporean investors looking to expand in Vietnam’s industrial sector (1).

Vietnam’s investment policies have played a crucial role in attracting Singaporean businesses. Investors benefit from preferential corporate income tax rates, including a 10% rate for the first 15 years, complete tax exemption for the first four years, and a 50% reduction for the following nine years. Import duty exemptions on goods for fixed asset creation further lower operational costs. Additionally, streamlined investment licensing procedures through a one-stop service have created an efficient and investor-friendly environment. These incentives have positioned Nam Dinh Vu as a highly attractive option for Singaporean enterprises seeking long-term growth (2).

With its prime location, robust infrastructure, and favorable investment policies, Nam Dinh Vu Industrial Park has proven to be a highly appealing destination for Singaporean enterprises. These advantages have contributed to the park’s growing success and position as a strategic hub for industrial and logistics activities in Vietnam. Looking ahead, with continued support from government incentives and its competitive edge in logistics, Nam Dinh Vu is poised to attract even more investment from Singaporean businesses. This growing interest will further solidify its role as a leading industrial park in the region, creating new opportunities for collaboration and growth for both local and international companies.

Source:

(1). Vietnam Investment Review

(2). ASEAN Briefing 2

2 -

Six Sigma Accounting Professional Corporation: Expert Tax Filing Assistance You Can Trust

At Six Sigma Accounting Professional Corporation, we understand how overwhelming tax season can be. With constantly changing rules and tight tax filing deadlines, it’s essential to have a reliable partner to help you navigate the complexities of tax returns. Located in Ajax, ON, we specialize in providing comprehensive tax filing assistance for individuals and businesses alike, ensuring your returns are filed accurately and on time.

Why Choose Us for Your Tax Filing Needs?

Tax season can bring confusion, especially with the many nuances of provincial tax returns and federal requirements. At Six Sigma Accounting Professional Corporation, we offer expert services that include the use of cutting-edge tax filing software designed to ensure that your returns are accurate, complete, and compliant. Our experienced professionals are here to guide you every step of the way, making your tax filing process as seamless as possible.

1. Stay on Top of Tax Filing Deadlines

Meeting tax filing deadlines is critical to avoiding penalties and interest. With constantly changing dates and the potential for confusion, it can be challenging to keep track. Our team is well-versed in the latest CRA deadlines and will ensure that your returns are filed on time. Whether you’re dealing with provincial tax returns or federal filings, we’ll make sure everything is submitted before the deadline.

2. Efficient Tax Filing with Advanced Tax Filing Software

At Six Sigma Accounting Professional Corporation, we utilize the most advanced tax filing software available to streamline the tax filing process. Our software not only speeds up the process but also minimizes the risk of human error, ensuring that all calculations are accurate and up-to-date with current tax laws. Whether you’re filing your personal or business taxes, our tech-driven solutions provide peace of mind.

3. Navigating Provincial Tax Returns

Taxes aren’t just about federal filings — understanding the specifics of your provincial tax returns is equally important. Different provinces have unique rules, credits, and deductions that can affect the amount of taxes you owe. As a local business serving the Ajax area, we are experts in Ontario provincial tax returns and can help you claim all eligible credits and deductions, reducing your tax liability and maximizing your refund.

4. Expert Tax Filing Assistance

Tax filing can be complex, especially for those with unique circumstances, such as multiple income sources, self-employment, or investments. Our team is here to provide tax filing assistance, whether you need help with your personal returns or more intricate business filings. We make sure that no detail is overlooked, and you get the maximum benefit possible from your filing.

Our Comprehensive Tax Filing Services

We offer a wide range of services to meet the needs of individuals, families, and businesses, including:

Tax Filing Assistance: Full support to ensure you meet all deadlines and file your returns accurately.

Provincial Tax Returns: Expert help with Ontario and other provincial tax requirements, ensuring you’re compliant and maximizing your deductions.

Advanced Tax Filing Software: Using the best tools available for secure, error-free tax filing.

Tax Filing Deadlines: We track deadlines for you, ensuring you avoid late penalties.

Get in Touch for Professional Tax Assistance

Don’t let tax filing deadlines or complex provincial tax returns stress you out. Contact Six Sigma Accounting Professional Corporation today at +1 (647) 697-9992 or visit our office at 75 Bayly St W, Ste 15 #801 Ajax, ON L1S 7K7. Our team of experts is here to provide the tax filing assistance you need to ensure a smooth and hassle-free tax season.

We take the confusion out of tax season, giving you the confidence that your returns are filed on time and in full compliance with all tax laws. Let us handle your taxes, so you can focus on what really matters!1 -

Six Sigma Accounting Professional Corporation: Expert Tax Filing Assistance You Can Trust

At Six Sigma Accounting Professional Corporation, we understand how overwhelming tax season can be. With constantly changing rules and tight tax filing deadlines, it’s essential to have a reliable partner to help you navigate the complexities of tax returns. Located in Ajax, ON, we specialize in providing comprehensive tax filing assistance for individuals and businesses alike, ensuring your returns are filed accurately and on time.

Why Choose Us for Your Tax Filing Needs?

Tax season can bring confusion, especially with the many nuances of provincial tax returns and federal requirements. At Six Sigma Accounting Professional Corporation, we offer expert services that include the use of cutting-edge tax filing software designed to ensure that your returns are accurate, complete, and compliant. Our experienced professionals are here to guide you every step of the way, making your tax filing process as seamless as possible.

1. Stay on Top of Tax Filing Deadlines

Meeting tax filing deadlines is critical to avoiding penalties and interest. With constantly changing dates and the potential for confusion, it can be challenging to keep track. Our team is well-versed in the latest CRA deadlines and will ensure that your returns are filed on time. Whether you’re dealing with provincial tax returns or federal filings, we’ll make sure everything is submitted before the deadline.

2. Efficient Tax Filing with Advanced Tax Filing Software

At Six Sigma Accounting Professional Corporation, we utilize the most advanced tax filing software available to streamline the tax filing process. Our software not only speeds up the process but also minimizes the risk of human error, ensuring that all calculations are accurate and up-to-date with current tax laws. Whether you’re filing your personal or business taxes, our tech-driven solutions provide peace of mind.

3. Navigating Provincial Tax Returns

Taxes aren’t just about federal filings — understanding the specifics of your provincial tax returns is equally important. Different provinces have unique rules, credits, and deductions that can affect the amount of taxes you owe. As a local business serving the Ajax area, we are experts in Ontario provincial tax returns and can help you claim all eligible credits and deductions, reducing your tax liability and maximizing your refund.

4. Expert Tax Filing Assistance

Tax filing can be complex, especially for those with unique circumstances, such as multiple income sources, self-employment, or investments. Our team is here to provide tax filing assistance, whether you need help with your personal returns or more intricate business filings. We make sure that no detail is overlooked, and you get the maximum benefit possible from your filing.

Our Comprehensive Tax Filing Services

We offer a wide range of services to meet the needs of individuals, families, and businesses, including:

Tax Filing Assistance: Full support to ensure you meet all deadlines and file your returns accurately.

Provincial Tax Returns: Expert help with Ontario and other provincial tax requirements, ensuring you’re compliant and maximizing your deductions.

Advanced Tax Filing Software: Using the best tools available for secure, error-free tax filing.

Tax Filing Deadlines: We track deadlines for you, ensuring you avoid late penalties.

Get in Touch for Professional Tax Assistance

Don’t let tax filing deadlines or complex provincial tax returns stress you out. Contact Six Sigma Accounting Professional Corporation today at +1 (647) 697-9992 or visit our office at 75 Bayly St W, Ste 15 #801 Ajax, ON L1S 7K7. Our team of experts is here to provide the tax filing assistance you need to ensure a smooth and hassle-free tax season.

We take the confusion out of tax season, giving you the confidence that your returns are filed on time and in full compliance with all tax laws. Let us handle your taxes, so you can focus on what really matters!1 -

Six Sigma Accounting Professional Corporation: Expert Tax Filing Assistance You Can Trust

At Six Sigma Accounting Professional Corporation, we understand how overwhelming tax season can be. With constantly changing rules and tight tax filing deadlines, it’s essential to have a reliable partner to help you navigate the complexities of tax returns. Located in Ajax, ON, we specialize in providing comprehensive tax filing assistance for individuals and businesses alike, ensuring your returns are filed accurately and on time.

Why Choose Us for Your Tax Filing Needs?

Tax season can bring confusion, especially with the many nuances of provincial tax returns and federal requirements. At Six Sigma Accounting Professional Corporation, we offer expert services that include the use of cutting-edge tax filing software designed to ensure that your returns are accurate, complete, and compliant. Our experienced professionals are here to guide you every step of the way, making your tax filing process as seamless as possible.

1. Stay on Top of Tax Filing Deadlines

Meeting tax filing deadlines is critical to avoiding penalties and interest. With constantly changing dates and the potential for confusion, it can be challenging to keep track. Our team is well-versed in the latest CRA deadlines and will ensure that your returns are filed on time. Whether you’re dealing with provincial tax returns or federal filings, we’ll make sure everything is submitted before the deadline.

2. Efficient Tax Filing with Advanced Tax Filing Software

At Six Sigma Accounting Professional Corporation, we utilize the most advanced tax filing software available to streamline the tax filing process. Our software not only speeds up the process but also minimizes the risk of human error, ensuring that all calculations are accurate and up-to-date with current tax laws. Whether you’re filing your personal or business taxes, our tech-driven solutions provide peace of mind.

3. Navigating Provincial Tax Returns

Taxes aren’t just about federal filings — understanding the specifics of your provincial tax returns is equally important. Different provinces have unique rules, credits, and deductions that can affect the amount of taxes you owe. As a local business serving the Ajax area, we are experts in Ontario provincial tax returns and can help you claim all eligible credits and deductions, reducing your tax liability and maximizing your refund.

4. Expert Tax Filing Assistance

Tax filing can be complex, especially for those with unique circumstances, such as multiple income sources, self-employment, or investments. Our team is here to provide tax filing assistance, whether you need help with your personal returns or more intricate business filings. We make sure that no detail is overlooked, and you get the maximum benefit possible from your filing.

Our Comprehensive Tax Filing Services

We offer a wide range of services to meet the needs of individuals, families, and businesses, including:

Tax Filing Assistance: Full support to ensure you meet all deadlines and file your returns accurately.

Provincial Tax Returns: Expert help with Ontario and other provincial tax requirements, ensuring you’re compliant and maximizing your deductions.

Advanced Tax Filing Software: Using the best tools available for secure, error-free tax filing.

Tax Filing Deadlines: We track deadlines for you, ensuring you avoid late penalties.

Get in Touch for Professional Tax Assistance

Don’t let tax filing deadlines or complex provincial tax returns stress you out. Contact Six Sigma Accounting Professional Corporation today at +1 (647) 697-9992 or visit our office at 75 Bayly St W, Ste 15 #801 Ajax, ON L1S 7K7. Our team of experts is here to provide the tax filing assistance you need to ensure a smooth and hassle-free tax season.

We take the confusion out of tax season, giving you the confidence that your returns are filed on time and in full compliance with all tax laws. Let us handle your taxes, so you can focus on what really matters!1 -

Six Sigma Accounting Professional Corporation: Expert Tax Filing Assistance You Can Trust

At Six Sigma Accounting Professional Corporation, we understand how overwhelming tax season can be. With constantly changing rules and tight tax filing deadlines, it’s essential to have a reliable partner to help you navigate the complexities of tax returns. Located in Ajax, ON, we specialize in providing comprehensive tax filing assistance for individuals and businesses alike, ensuring your returns are filed accurately and on time.

Why Choose Us for Your Tax Filing Needs?

Tax season can bring confusion, especially with the many nuances of provincial tax returns and federal requirements. At Six Sigma Accounting Professional Corporation, we offer expert services that include the use of cutting-edge tax filing software designed to ensure that your returns are accurate, complete, and compliant. Our experienced professionals are here to guide you every step of the way, making your tax filing process as seamless as possible.

1. Stay on Top of Tax Filing Deadlines

Meeting tax filing deadlines is critical to avoiding penalties and interest. With constantly changing dates and the potential for confusion, it can be challenging to keep track. Our team is well-versed in the latest CRA deadlines and will ensure that your returns are filed on time. Whether you’re dealing with provincial tax returns or federal filings, we’ll make sure everything is submitted before the deadline.

2. Efficient Tax Filing with Advanced Tax Filing Software

At Six Sigma Accounting Professional Corporation, we utilize the most advanced tax filing software available to streamline the tax filing process. Our software not only speeds up the process but also minimizes the risk of human error, ensuring that all calculations are accurate and up-to-date with current tax laws. Whether you’re filing your personal or business taxes, our tech-driven solutions provide peace of mind.

3. Navigating Provincial Tax Returns

Taxes aren’t just about federal filings — understanding the specifics of your provincial tax returns is equally important. Different provinces have unique rules, credits, and deductions that can affect the amount of taxes you owe. As a local business serving the Ajax area, we are experts in Ontario provincial tax returns and can help you claim all eligible credits and deductions, reducing your tax liability and maximizing your refund.

4. Expert Tax Filing Assistance

Tax filing can be complex, especially for those with unique circumstances, such as multiple income sources, self-employment, or investments. Our team is here to provide tax filing assistance, whether you need help with your personal returns or more intricate business filings. We make sure that no detail is overlooked, and you get the maximum benefit possible from your filing.

Our Comprehensive Tax Filing Services

We offer a wide range of services to meet the needs of individuals, families, and businesses, including:

Tax Filing Assistance: Full support to ensure you meet all deadlines and file your returns accurately.

Provincial Tax Returns: Expert help with Ontario and other provincial tax requirements, ensuring you’re compliant and maximizing your deductions.

Advanced Tax Filing Software: Using the best tools available for secure, error-free tax filing.

Tax Filing Deadlines: We track deadlines for you, ensuring you avoid late penalties.

Get in Touch for Professional Tax Assistance

Don’t let tax filing deadlines or complex provincial tax returns stress you out. Contact Six Sigma Accounting Professional Corporation today at +1 (647) 697-9992 or visit our office at 75 Bayly St W, Ste 15 #801 Ajax, ON L1S 7K7. Our team of experts is here to provide the tax filing assistance you need to ensure a smooth and hassle-free tax season.

We take the confusion out of tax season, giving you the confidence that your returns are filed on time and in full compliance with all tax laws. Let us handle your taxes, so you can focus on what really matters!1 -

Feminism is Harmful to Society

Feminism may be defined as an activity aimed at preserving women’s rights and interests. The initial objective of the movement was to aid women play an equal role in a mainly male society. However, with time, the idea of equality of sexes has transformed into a battle where feminists intend to outdo men. Such toxic metamorphoses have made feminism dangerous to the society.

The ideology of the modern feminism falsely positions women as victims. Women, just as men, are capable of making competent decisions in accordance with their wishes individually and do not require extra advantages. Treating females as the oppressed gender encourages women to put the blame for any intellectual or physical challenge either at work or study on a male will. Such impact of feminism leads to the formal recognition of women as a victimized class and triggers a shift in the legal framework towards one of the sexes.

Unfortunately, men have to face one of the most unpleasant effects of feminism. The idea popularized by some feminists is that the latter are the worthless accessories in a woman’s life. Radical feminism has affected the law system. For instance, after separation, fathers are regarded as sponsors of their children. The incapability to fulfill the obligation leads to severe implications such as the loss of the driver’s license and examination of income tax return. On the contrary, there is no requirement for the mothers even to provide fathers with access to the children.

Finally, feminism badly affects families. With time, the initial principles of feminism were lost. Radical transformations of ideology took place in the 1960s and 1970s when the “Women’s Liberation” movement enjoyed vogue. The proponents of the movement approved sexual affairs outside marriage neglecting the core family values. Therefore, the lifestyle promoted by feminists is barely suitable for raising children.

Women have experienced numerous forms of institutionalized discrimination in different times and various cultural environments. This is a bitter but indisputable truth. However, in the race for the revenge, feminism has radicalized and deviated from its high aspirations. Modern feminism breeds hatred against men and destroys families thus being harmful to society.

Written by Emily Stafford, the best writer at https://perfectessaysonline.com/ -

Tax Relief R Us: Your Trusted Partner for Tax Filing Near Me and Tax Help Near Me in Jackson Heights, NY

At Tax Relief R Us, we understand that taxes can be confusing, stressful, and time-consuming. Whether you’re looking for tax filing near me or tax help near me, our team is here to provide you with expert assistance to ensure that your taxes are filed accurately, on time, and with minimal hassle. Located at 8315 Northern Blvd #2, Jackson Heights, NY 11372, we proudly serve clients throughout the New York area, offering a wide range of tax services for individuals and businesses alike.

When you choose Tax Relief R Us, you’re choosing a dedicated team that’s committed to offering reliable, efficient, and personalized tax help near me. We strive to make the tax filing process as smooth as possible so that you can focus on what matters most.

Tax Filing Near Me: Expert Services for Stress-Free Tax Filing

If you're searching for tax filing near me, it’s important to find a trusted team who can handle your tax needs with care and precision. At Tax Relief R Us, we offer expert tax filing services to ensure that your tax returns are completed accurately and filed on time.

Here’s how we can help with tax filing near me:

Personal Tax Filing: Filing your personal taxes can be complicated, especially when you have multiple income sources, deductions, or credits to consider. Our team will help you navigate the process and ensure you file your taxes in a way that maximizes your refund or minimizes your tax liability.

Business Tax Filing: For businesses, tax filing is a vital part of maintaining compliance with federal, state, and local regulations. Whether you’re a sole proprietor, an LLC, or a corporation, we offer tax filing services that help your business stay on top of its tax obligations.

State and Federal Tax Returns: We handle both state and federal tax returns for individuals and businesses. Our team ensures that all forms are completed correctly and that you receive all the deductions and credits you’re eligible for, minimizing your overall tax liability.

Electronic Filing (E-filing): To speed up the process and ensure your tax returns are filed securely, we offer e-filing services. E-filing is the fastest way to get your tax returns processed and can result in a quicker refund.

Tax Deadline Management: Keeping track of important tax deadlines can be stressful. Our team helps you stay organized by ensuring that your tax filings are completed well in advance of due dates, so you never miss a deadline.

With Tax Relief R Us, you can trust that your tax filing will be handled by professionals who have your best interests at heart.

Tax Help Near Me: Providing Professional Assistance for All Your Tax Needs

If you’re looking for tax help near me, it’s likely because you need expert advice and support to resolve tax-related issues or concerns. At Tax Relief R Us, we provide comprehensive tax help designed to make your life easier and relieve you of the stress that often accompanies tax issues.

Here’s how we can provide tax help near me:

Tax Debt Resolution: Are you struggling with unpaid taxes or tax debt? We can help you find solutions for resolving your tax debt, including installment agreements, Offer in Compromise, and other tax relief options. Our team works directly with the IRS to negotiate a settlement that works for you.

IRS Representation: If you’re facing an audit or dealing with IRS collections, we can represent you before the IRS. Our experts will handle communications with the IRS on your behalf and work to resolve any issues as quickly as possible.

Back Taxes Help: Falling behind on taxes can feel overwhelming, but it’s not the end of the road. Our team is experienced in helping clients with back taxes, finding ways to get you back on track and reduce penalties and interest. 1

1 -

A&L Bookkeeping: Your Trusted Bookkeeping Services in Poinciana, FL

At A&L Bookkeeping, we understand how essential it is for small business owners and entrepreneurs to maintain accurate and organized financial records. Whether you're just starting out or have been in business for years, having reliable bookkeeping services is key to your business’s success. If you’re searching for professional bookkeeping services in Poinciana, you’ve come to the right place.

Our team of experts provides comprehensive bookkeeping services tailored to meet the unique needs of businesses in Poinciana, FL, and surrounding areas. From day-to-day financial tracking to detailed reporting, we ensure that your financial records are in excellent hands, allowing you to focus on growing your business.

Why Choose A&L Bookkeeping for Bookkeeping Services in Poinciana?

A&L Bookkeeping is committed to providing top-notch bookkeeping services in Poinciana, designed to keep your business financially organized and efficient. Here’s why businesses in Poinciana and beyond trust us with their bookkeeping needs:

Local Expertise: As a trusted bookkeeping firm located in Poinciana, FL, we specialize in understanding the specific financial needs of local businesses, whether you’re in retail, hospitality, or any other industry.

Customized Solutions: We take the time to understand your business’s operations and create a tailored bookkeeping plan that fits your unique requirements.

Affordable Services: Our bookkeeping services near Poinciana, FL, are designed to be cost-effective, providing high-quality financial management without breaking the bank.

Experienced Professionals: Our team consists of experienced and knowledgeable bookkeepers who ensure your financial records are accurate, compliant, and up to date.

QuickBooks Experts in Poinciana: Get the Most Out of Your Accounting Software

If you use QuickBooks for managing your business’s finances, you know how powerful this tool can be. However, getting the most out of QuickBooks requires expertise and a deep understanding of its features. As QuickBooks experts in Poinciana, we can help you set up, maintain, and optimize your QuickBooks account to ensure it works efficiently for your business.

Our QuickBooks services include:

QuickBooks Setup: We help you set up your QuickBooks account from scratch, ensuring it is configured properly to meet your business needs.

Monthly Reconciliation: Our team ensures that your financial data is consistently reconciled, so your books are always accurate and up to date.

Custom Reporting: We generate detailed, customized financial reports from QuickBooks, so you can easily track your income, expenses, profits, and losses.

Training and Support: If you're new to QuickBooks or want to improve your skills, we offer training sessions to help you become proficient with the software and make the most out of its features.

With A&L Bookkeeping as your QuickBooks experts in Poinciana, you’ll be able to maximize the benefits of this powerful tool and streamline your financial operations.

Convenient Bookkeeping Services Near Poinciana, FL

Whether you're located in Poinciana, FL, or the surrounding areas, A&L Bookkeeping is proud to offer convenient and reliable bookkeeping services near Poinciana, FL. We understand the importance of having accurate financial records to make informed decisions and keep your business running smoothly.

Our bookkeeping services include:

Transaction Management: We handle day-to-day bookkeeping tasks, such as tracking sales, expenses, and invoices, to keep your financial records up to date.

Bank Reconciliation: We reconcile your business accounts regularly, ensuring that your financial records match your bank statements and preventing discrepancies.

Financial Statements: We prepare regular financial statements such as balance sheets, profit and loss reports, and cash flow statements to provide a clear picture of your business’s financial health.

Tax Preparation: Our team ensures that your books are organized and accurate, making tax season a breeze and helping you avoid costly mistakes.

If you’re looking for bookkeeping services near Poinciana, FL, our team is just a phone call away. We provide the support you need to stay organized and compliant, no matter where you are.

Why Businesses Choose A&L Bookkeeping

At A&L Bookkeeping, we pride ourselves on providing comprehensive, reliable, and affordable bookkeeping services that businesses in Poinciana, FL, can trust. Here’s why so many local businesses choose us:

Professionalism and Expertise: Our experienced team of bookkeepers is dedicated to providing exceptional service and helping businesses succeed.1 -

O'Sullivan Accounting LLC: Comprehensive Accounting and Tax Services in Vero Beach, Florida

At O'Sullivan Accounting LLC, located in Vero Beach, Florida, we offer a wide range of accounting and tax services designed to meet the needs of both individuals and businesses. Whether you're a small business owner looking for sales tax services, a non-profit organization needing help with 990 filings, or an individual filing your 1040, our expert team is here to help you navigate the complexities of tax law and financial management.

Why Choose O'Sullivan Accounting LLC?

We understand that taxes can be overwhelming. Whether you're managing federal income tax returns, seeking assistance with resale certificates, or navigating the intricacies of different business forms like 1120 or 1065, O'Sullivan Accounting LLC is here to simplify the process. With a team of experienced professionals, we ensure your finances are in order and that you’re compliant with all tax regulations, helping you avoid costly mistakes and optimize your financial strategy.

Our Specialized Services

Sales Tax Services

Sales tax services are essential for businesses to stay compliant with state and local tax regulations. At O'Sullivan Accounting LLC, we assist businesses with calculating, collecting, and remitting sales tax to ensure you meet all your obligations. Our team also provides guidance on exemptions, ensuring that your business handles sales tax efficiently and correctly.

Resale Certificate

A resale certificate is vital for businesses purchasing goods to resell, as it allows you to buy items without paying sales tax. We help businesses apply for and manage their resale certificate, ensuring they’re eligible to make tax-exempt purchases in compliance with state laws.

Non-Profit Organizations

For non-profit organizations, managing finances and staying compliant with tax laws is crucial. We provide specialized accounting services for non-profits, including 990 filings. Our team helps ensure that your organization is meeting its reporting requirements, maintaining transparency, and securing its tax-exempt status.

Federal Income Tax Return

Preparing and filing your federal income tax return can be a complicated process. At O'Sullivan Accounting LLC, we provide expert guidance for both individuals and businesses. Our team ensures that your federal income tax return is filed accurately and on time, helping you take advantage of available deductions and credits.

Form 1040

As an individual, filing your 1040 form is essential for reporting income, deductions, and tax liabilities. Our professionals offer tax preparation services to help you file your 1040 form accurately, ensuring that you comply with IRS requirements while maximizing your tax refund.

Form 1120

For corporations, filing the 1120 form is a requirement to report income, deductions, and other necessary financial information. We help corporations prepare and file 1120 returns, ensuring compliance with federal tax regulations and optimizing your corporate tax strategy.

Form 1120S

Form 1120S is used by S corporations to report their income, deductions, and other financial details. Our team specializes in preparing 1120S forms for S corporations, ensuring that all required information is accurately reported and your business takes full advantage of potential tax benefits.

Form 1065

Partnerships are required to file Form 1065 to report income, deductions, and distributions to partners. At O'Sullivan Accounting LLC, we assist partnerships with the preparation and filing of 1065 forms, ensuring accuracy and compliance with IRS requirements.

Form 990

Form 990 is essential for non-profit organizations to report their financial information to the IRS. We help non-profits prepare and file 990 forms, ensuring that they meet their annual filing requirements and maintain their tax-exempt status.

Why Work With Us?

At O'Sullivan Accounting LLC, we are dedicated to providing personalized, professional tax services to meet the diverse needs of our clients. Whether you're a small business owner needing sales tax services or a non-profit organization filing 990 forms, our team is here to guide you through the tax process with ease. We specialize in preparing all necessary forms, including 1040, 1120, 1120S, 1065, and more, ensuring that your filings are accurate, timely, and fully compliant.

We pride ourselves on offering clear, reliable advice and making complex tax matters easier for our clients. Our approach ensures that you’re well-prepared for tax season and that your financial records are always in order.

Contact Us Today

Let O'Sullivan Accounting LLC take the stress out of your accounting and tax needs. Whether you need help with sales tax services, preparing your federal income tax return, or filing 990 forms for your non-profit, we have the expertise to support you every step of the way.8